Defining and Explaining the Income Statement or P&L

- Acumen Learning

- Mar 25, 2022

- 4 min read

Updated: Nov 14, 2022

If you know anything about business you probably know, there are a lot of important documents. But, in my opinion, one of the MOST important documents is the income statement. Now, I’m sure you’ve heard of an income statement, but if you haven’t you may have heard it called by one of its other common names: statement of income, statement of operations, earnings statement, or one of the most popular… the profit and loss statement (or P&L). I know… this is confusing… why all the names? Well, if you believe college-aged me, it’s because the financial guru's of the world are trying to confuse you. BUT, even if it's called something else, the good news is if you look at the income statement, it’s very easily recognizable.

When compiling an income statement in the United States, Generally Accepted Accounting Principles (GAAP) are typically followed, meaning they are typically put together in the same way, following the same rules. So, if you follow these formats, your organization can call the income statement whatever you’d like.

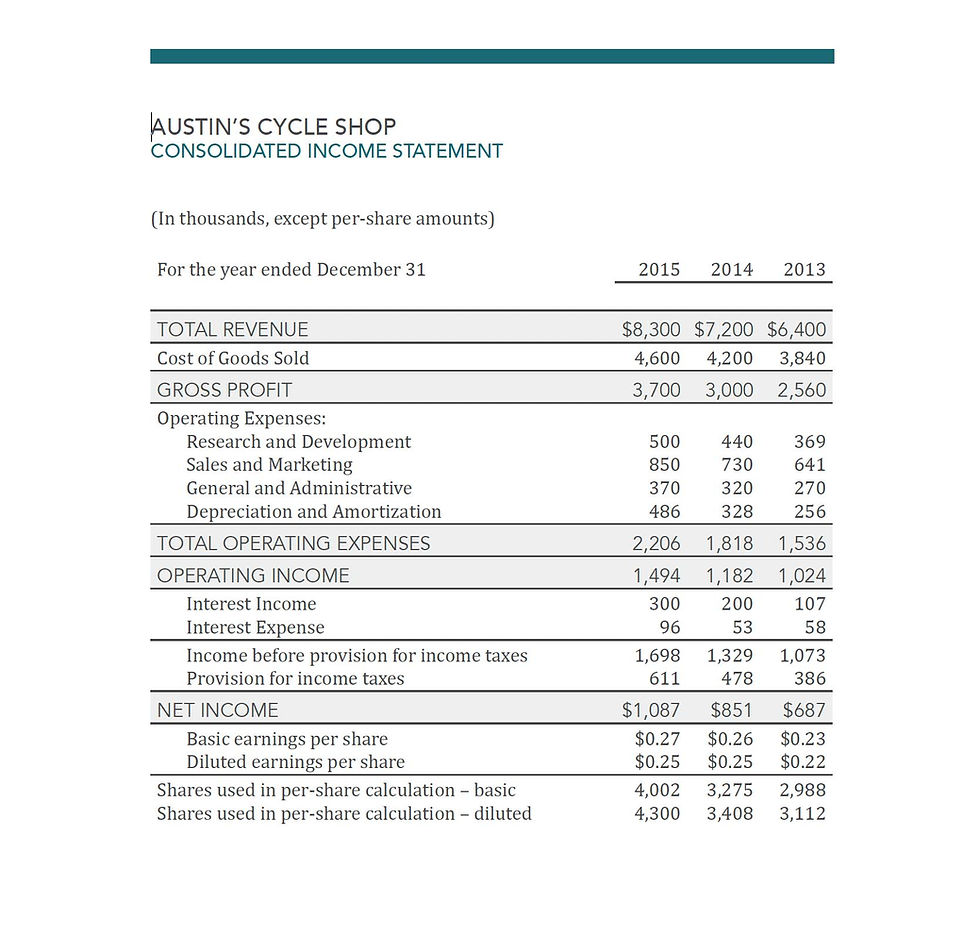

Above you'll see an example of an income statement from a factious company - Austin's Cycle Shop. Looking at it, you can see at the top, there are multiple years listed, and down the left side you’ll see the three (or sometimes four…I’ll get into that later) major numbers. By showing multiple years, it allows you to see year-over-year, the way the numbers are trending. So, on the income statement you can see your revenue year-over-year, as well as operating or controllable expenses, and net profit or net income. These three numbers are avidly tracked by executive teams and the stock market, which means you’ll want to make sure that these numbers are managed extremely well.

So, why would there be a fourth number? Well, your company is publicly traded, like Austin's Cycle Shop, your earnings per share would also be listed.

Year-over-year, these four numbers (sales/revenue, operating income, net profit, and earnings per share) should all be trending upward. This would indicate that your company is doing well. However, if any one of these numbers is trending downward, that’s a red flag, and your executive team needs to examine this trend to determine what exactly is happening, and what you need to do to fix it.

Why is the income statement so important?

Well - it’s because the income statement is typically used to manage the details and strategy of the business. Why? Well, using business acumen, it's easy to look at an income statement and compare the years to see if your strategy is working. If it's not, you can use these numbers to see where you need to dig to determine what isn't going according to plan, and how to fix it.

For example, if you look at sales on the income statement and it’s going down, there are a couple reasons that could be happening. One could be that your competition is creeping in and taking over some of your market share, or you could have products that are starting to not perform as well. If you use an income statement and can clearly see number declining, you can then work to figure out why they are declining and develop a solution to address that problem.

On the income statement, one number that is particularly important is the operating income. That's because it will tell you how well you’re managing your controllable expenses. Some of these expenses include your Selling, General & Administrative expenses (SG&A), marketing expenses, shipping, R&D, and more(check out Austin's operating expenses above to get an idea of more things that can go into this bucket). It's important that these expenses are tracked and managed to ensure that you continue to have money to invest back into the company to grow the business.

You also have the net income which takes all of those expenses that we’ve mentioned, but you add in taxes and the interest you might pay to borrow money. The good news is, many companies can borrow money at incredibly low interest rates, some as low as 0.5%.

Next is Earnings per share or EPS. EPS is very closely monitored by the stock market for public traded companies. Why? Well, it's because this number is really a reflection of how well you are managing all of your other numbers. Are you drawing profit the way you should? What are you doing with your shares? Are you buying back shares or selling them because you need the money? These things all speak volumes about what is happening inside your business.

So these four numbers: top line sales or revenue, operating income or EBIT (Earnings Before Interest and Taxes), net income or net profit, and earnings per share – the four key numbers or metrics on any profit and loss statement. So, that’s what I look at. I look at those numbers and I measure the growth on each of those metrics, and look at the difference in growth rates. That’s a key to helping a company really grow, because if you can learn to become more profitable, you take that money and you’re able to leverage it to grow your business in different ways.

✅ Subscribe to our YouTube channel for more videos with business acumen definitions, stories, tips, and tricks!

✅ Visit our website to learn more about our business acumen training and impacts it has on organizations.